Savings tips and strategies

Navigating college planning options and saving strategies can be an overwhelming process for most families. The following articles are designed to help you become more familiar with college tuition costs and financial aid options, as well the various tax benefits of college savings plans.

Funding a college education: Important considerations >

Saving for college – You don’t have to do it alone >

Weighing the features and benefits to pick your 529 plan >

Funding a college education: Important considerations

As you navigate along the path of saving for a child’s college education and work with your financial professional to better define your college savings needs, it is important to take into consideration the various factors that can impact college costs — and your bottom line.

Understanding college costs

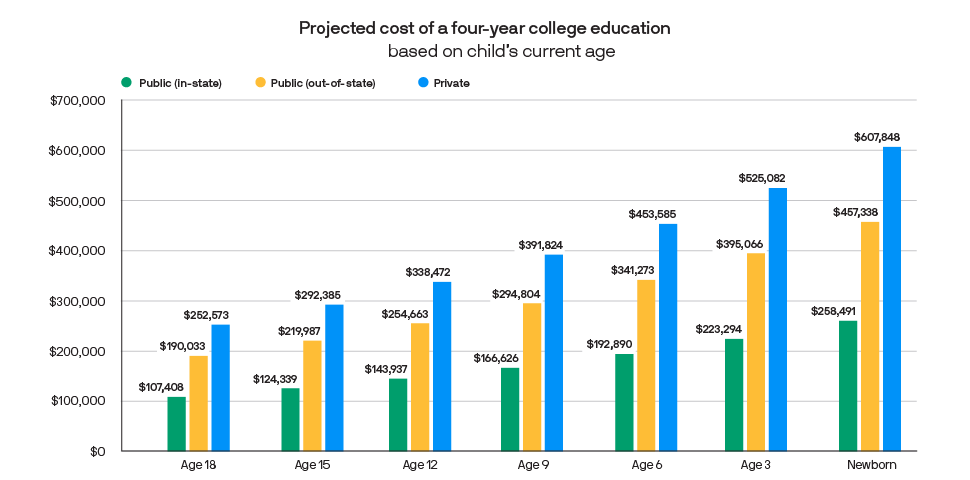

It’s no surprise that the cost of a college education is continuing to climb rapidly. In fact, tuition rates are now outpacing the costs of many other goods and services. This chart estimates the costs of a four-year education, including tuition and room and board, at both an in-state public college and a private college in the years ahead.

While the sticker price for college does seem overwhelming, the good news is that college can become more affordable when you begin to save and invest now instead of borrowing later. Starting a 529 plan early and investing regularly may allow you to significantly reduce your expenses and debt in the future when college bills come due.

Costs based on 2016-2017 estimate of average tuition and room and board in current dollars for four-year public and private universities according to the 2011 Trends in College Pricing, published by the College Board. Projected pricing assumes a 5% annual rate of increase in college costs.

The chart is shown for illustrative purposes only. Past performance is no guarantee of future results.

Realities of financial aid and scholarships

Many families earn too much to qualify for need-based aid, and even the brightest students rarely receive full scholarships. With a 529 plan, you control a child’s education, not the financial aid office. And if you apply for federal aid, 529 plan assets owned by the parent typically have less influence on eligibility than accounts held in the student’s name. Given this reality, it is important to familiarize yourself with how financial aid is awarded and how you may be able to maximize your chances of getting aid.

Learn more: Financial aid myths and facts

Consider all higher education options

Most parents focus on the average cost of public or private colleges when determining their college savings goals. The truth is that students today have access to a wide range of higher education options, including two-year community schools, vocational schools and long-distance programs, which cost much less than traditional four-year colleges. Even among four-year college pricing, there is a wide variance between in-state college costs and the cost of a four-year education at a private school. So before you get too discouraged to even start saving, consider the type of college education that would best meet the needs of your future student.

Weighing the features and benefits to pick your 529 plan

All 529 college savings plans are designed to help you save for college, but not all plans are created equal. Each state plan varies by tax benefits, investment options, performance and fees.

You generally don’t have to be a resident of a particular state to invest in a specific plan. For example, a resident of New Jersey can still invest in New York’s 529 Advisor-Guided College Savings Program. Certain states, however, may offer incentives for residents or beneficiaries selecting their home state’s plan. Be sure to consult your tax professional or review the state’s program documents for further details.

Consider the following guidelines to help you select the plan that is most appropriate for you.

In-state resident benefits

In addition to federal tax benefits, some states may offer their residents additional incentives for selecting their home state’s plan, such as a state income tax deduction or credit for investing. The value of a state tax benefit may vary from state to state and is applicable to both the direct-sold and the financial professional-sold plans sponsored by any given state. Certain states also may offer matching grant programs or scholarships, but these incentives may be limited or unavailable for residents at specific income levels.

When evaluating a particular state’s plan, you should weigh any potential tax advantages with other features, such as quality of investment options and plan fees, in order to make an informed decision. You may discover that your state plan offers attractive tax benefits, but has higher fees than another state’s plan. It is important to work with your financial professional to select the best plan for your particular situation.

Investment lineup

While most plans offer a choice of portfolios to select from, some plans offer a wider range of investments than others. When evaluating a plan’s investment lineup, look for strategies that are most closely aligned with your needs and goals. For example, if you are uncomfortable selecting your own investments, consider an age-based portfolio, where account assets are automatically invested based on the age of your child. Again, consult with your financial professional for help choosing the investment option that is most appropriate for your college-savings goals.

Performance

Typically, 529 college savings plan portfolios provide a documented history of performance, as well as performance history of the portfolio’s underlying investments. Remember, past performance is not indicative of future results and does not guarantee investment returns. In addition to performance, be sure to consider the background and experience of investment managers, as well as the consistency of their track record.

Working with a financial professional or taking a "do-it-yourself" approach

One important decision to make when choosing the right college savings plan for your needs is whether you would like to work with a financial professional or take a "do-it-yourself" approach with a direct-sold plan. Direct-sold plans usually offer lower expenses while financial professional-sold 529s include sales charges, making them comparatively more expensive. However, the benefit of having access to a financial professional is that you can receive advice about selecting the 529 plan and investments best suited to your goals and risk preferences. Additionally, financial professionals can help you with other financial goals beyond college savings.

Fees and expenses

529 college savings plans charge their investors various fees and expenses. These charges can vary between plans, but may include account fees, one-time enrollment/annual maintenance fees, asset management fees, program management fees and state administrative fees.

Saving for college – You don't have to do it alone

Trying to keep up with rising tuition costs can be tough, but saving and investing for your child's future isn't a challenge you have to take on alone. Consider one or all of the following strategies to help support your own savings efforts.

The gift of college savings – friends and family can help

You generally don't have to be a resident of a particular state to invest in a specific plan. For example, a resident of New Jersey can still invest in New York's 529 Advisor-Guided College Savings Program. Certain states, however, may offer incentives for residents or beneficiaries selecting their home state's plan. Be sure to consult your tax professional or review the state's program documents for further details.

Consider the following guidelines to help you select the plan that is most appropriate for you.

Parents, grandparents, aunts, uncles and even friends can help contribute to a child's college education by contributing to your beneficiary's 529 plan or by opening their own. For example, suggest a contribution to your child's 529 account when friends and family inquire about gift ideas for birthdays, graduations, holidays or other special occasions. Contributing to college savings instead of buying toys or traditional presents is a lifelong gift that will never go out of style—and can make a meaningful difference in a child's future.

Additionally, grandparents can transfer wealth and leave a lasting legacy to future generations by opening a 529 account. Opening or contributing to an account can offer attractive estate planning benefits as well, since 529 contributions are considered completed gifts for federal gift and estate purposes and are excluded from an account owner's estate.

Learn more about Ugift®, an online tool to help friends and family contribute to your Advisor-Guided Plan account.

When evaluating a particular state's plan, you should weigh any potential tax advantages with other features, such as quality of investment options and plan fees, in order to make an informed decision. You may discover that your state plan offers attractive tax benefits but has higher fees than another state's plan. It is important to work with your financial professional to select the best plan for your particular situation.

Add to your college savings

Upromise® is free to join and lets you turn everyday spending purchases into extra money for college savings. Upromise members can earn college savings on everyday spending purchases at a number of online and service locations, including retail/travel websites, grocery stores and restaurants. Best of all, when you join Upromise, you can link your Upromise account to your Advisor-Guided Plan account so your earnings can be automatically transferred on a periodic basis. Visit www.upromise.com for more information.1

Learn more about Upromise

Involve your child in the savings process

Encourage your child to invest a portion of his or her savings toward their college education. As they get older, children can begin to allocate a portion of their allowance or money from after-school or summer jobs to their college savings. They also can contribute some or all of their high school graduation money to their college education as well. By encouraging regular saving, you may be doing more than helping your child grow his or her college savings—you also may be teaching an enduring lesson about financial priorities and the value of a college education.

1Upromise is an optional service offered by Upromise, Inc., is separate from New York’s 529 Advisor-Guided College Savings Program and is not affiliated with the State of New York. Specific terms and conditions apply. Participating companies, contribution levels, terms and conditions subject to change without notice. Transfers subject to $25 minimum.

Quick Links

FAQs

Q. How do I open an Advisor-Guided Plan account?

A. You may open an account by contacting any broker or financial professional.

Q. How much can I contribute to my account?

A. You can contribute on behalf of a beneficiary until the total balance of all Program accounts held for the same beneficiary reaches an aggregate maximum balance, currently $520,000. If there's more than one account owner contributing for the beneficiary, this is the total for all accounts. Once this limit is reached, you can no longer make additional contributions, but you can continue to accumulate earnings.

Need more information? Find answers to all your college savings questions here >