Estate Planning

Estate and gift tax advantages

For families with estate planning needs, 529 college savings plans such as the Advisor-Guided Plan offer the added potential for helping to reduce estate taxes while giving children a gift that lasts a lifetime.

Reduce your taxable estate without giving up control of assets

Contributions to 529 plans are considered completed gifts, which means current assets and future earnings are excluded from your taxable estate—even though you retain control for the life of the account. As the account owner, you can name and change account beneficiaries. You choose investments. You alone control withdrawals. If circumstances change, you can even return assets to your estate, subject to taxes and penalties.

Give five years' worth of tax-free gifts in a single year

Federal gift taxes generally apply to any gifts exceeding $19,000 per beneficiary each year ($38,000 for married couples). With the Advisor-Guided Plan, you can gift five times that amount in a single year – free from gift taxes.1 Gifting up to $95,000 per beneficiary ($190,000 for married couples) may benefit investors looking to make up for lost time as beneficiaries approach college age or remove sizable assets from an estate.

1 No additional gifts can be made to the same beneficiary over a five-year period. If the donor does not survive the five years, a portion of the gift is returned to the taxable estate.

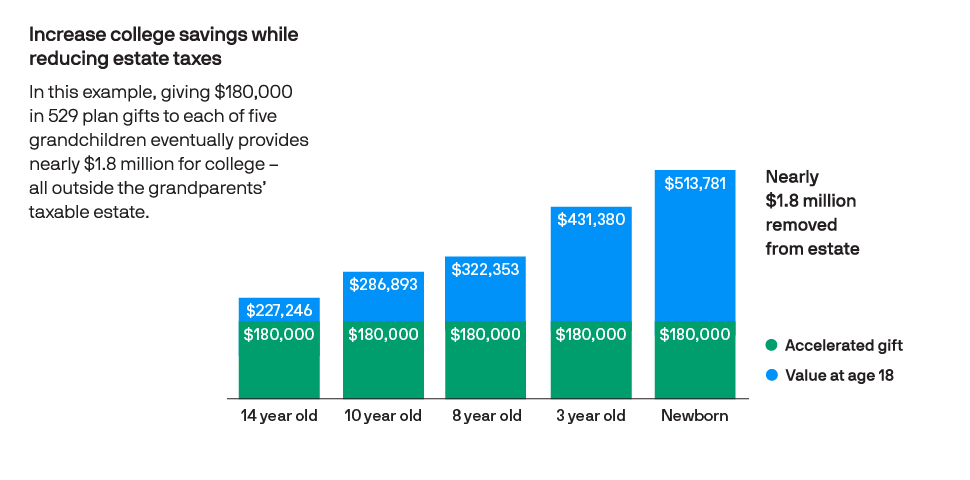

Case study: Accelerated gifts to five grandchildren

Fred and Diane Smith want to reduce estate taxes while helping their five grandchildren earn a college diploma. By contributing $160,000 to each child's 529 account today, the Smiths eventually remove nearly $1.6 million from their taxable estate — the initial gifts, plus all future investment gains.

Source: J.P. Morgan Asset Management. Illustration assumes an annual investment return of 6%. This example does not represent the performance of any particular investment. Different assumptions will result in outcomes different from this example. Your results may be more or less than the figures shown. Investment losses could affect the relative tax-deferred investing advantage. Each investor should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision, as the illustration may not reflect these factors. These figures do not reflect any management fees or expenses that would be paid by a 529 plan participant. Such costs would lower performance.

This chart is shown for illustrative purposes only. Past performance is no guarantee of future results.

FAQs

Q. Who can set up a 529 college savings account?

A. The plan is open to all U.S. citizens and resident aliens, regardless of income level or state of residence. Even entities such as trusts may establish an account.

Q. How much can I contribute to my account?

A. You can contribute on behalf of a beneficiary until the total balance of all Program accounts held for the same beneficiary reaches an aggregate maximum balance, currently $520,000. If there's more than one account owner contributing for the beneficiary, this is the total for all accounts. Once this limit is reached, you can no longer make additional contributions, but you can continue to accumulate earnings.

Need more information? Find answers to all your college savings questions here >