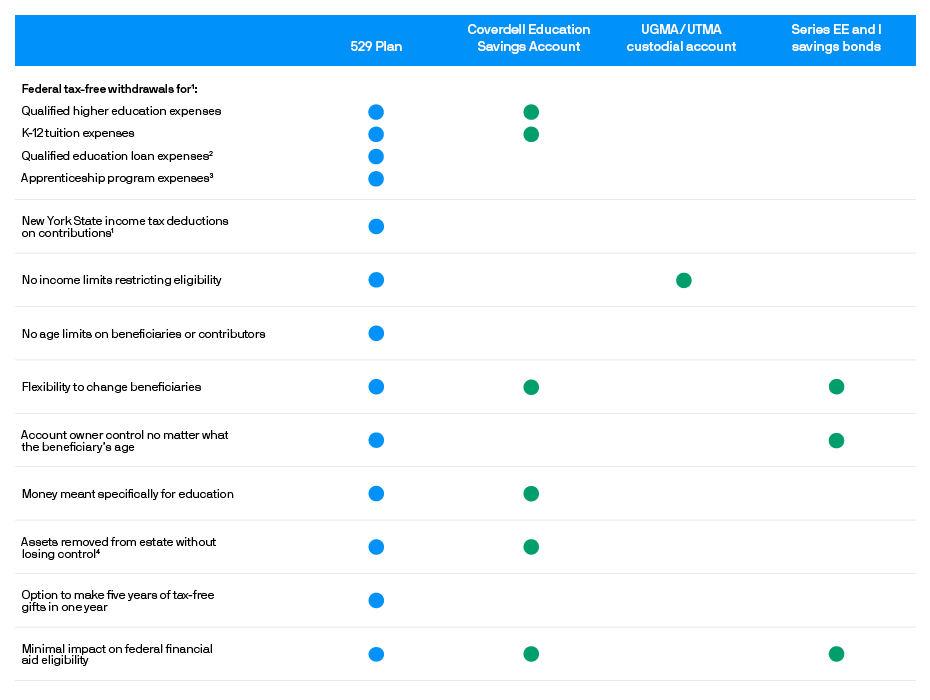

Compare Savings Options

Saving for college is challenging enough. With so many options, finding the right savings strategy is crucial. In addition to 529 plans, college savings alternatives include UGMA/UTMA accounts, Coverdell Education Savings Accounts, and Series EE and Series I savings bonds. As you can see from the comparison chart below, a 529 plan offers benefits not typically found in other types of education accounts.

1 Assuming account owner and contributor is the same person.

FAQs

Q. Can other people contribute to my account?

A. Yes, family and friends can contribute to your existing account or open their own account if they want the tax benefits and control. However, all account balances together for a beneficiary cannot exceed $520,000. After that, accounts can grow only through investment earnings.

Need more information? Find answers to all your college savings questions here >